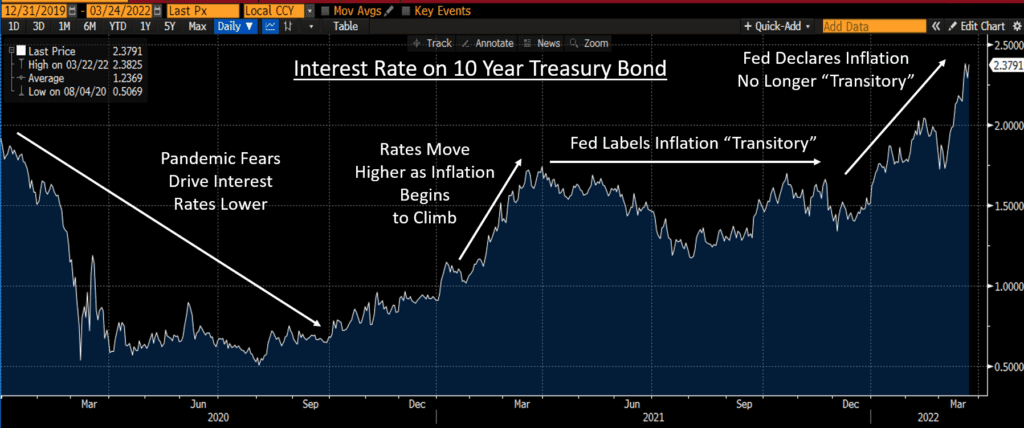

Interest rates have experienced significant volatility over the past few years given the pandemic, shut-downs, re-opening, additional waves of infection, global supply chain issues, and now, the Russian invasion of Ukraine.

Source: Bloomberg; Nottingham Advisors 2022

When market interest rates decline, bond prices tend to rise. For example, a 5-year Treasury bond with a 2% coupon (the amount of interest paid annually), trading at face value ($1,000), and yields 2%. If market rates decline to 1%, the bond’s price must rise to reduce the yield to the market level. This will result in a price higher than face value (the amount you receive when the bond matures), which will offset a portion of the coupon payment that you receive, lowering the bond’s yield to the current market rate. A bond portfolio’s value increases, as market interest rates decrease.

Source: eTrade; https://us.etrade.com/knowledge/library/bonds-cds/bond-interest-rate-inflation

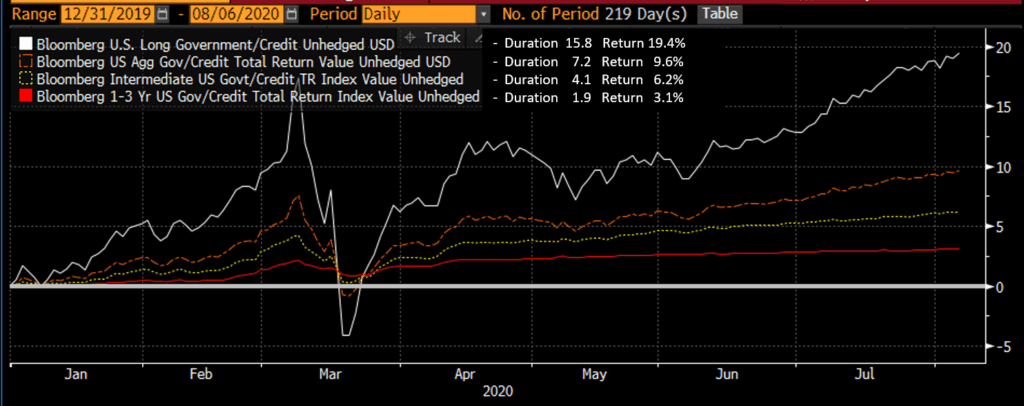

This move is magnified by the length of the average maturity/duration of the bonds. More duration results in larger price movements.

Interest rates plunged in early 2020 as the pandemic came into focus. The 10-year Treasury bond yield declined to ½ of 1% (50 basis points) at its lowest point. A yield that low clearly signals strong concerns about future economic growth, which makes sense in the middle of a pandemic, amid rolling economic shut-downs. Even with a cloudy economic outlook, this large decline in yields was a positive for the performance of bond portfolios. The longer the duration, the higher the return realized.

Source: Bloomberg; Nottingham Advisors 2022

There is some symmetry in how bond prices move. In 2020, prices went up as interest rates went down. In 2021 and into 2022, prices reversed course and went down as interest rates have gone up.

Source: eTrade; https://us.etrade.com/knowledge/library/bonds-cds/bond-interest-rate-inflation

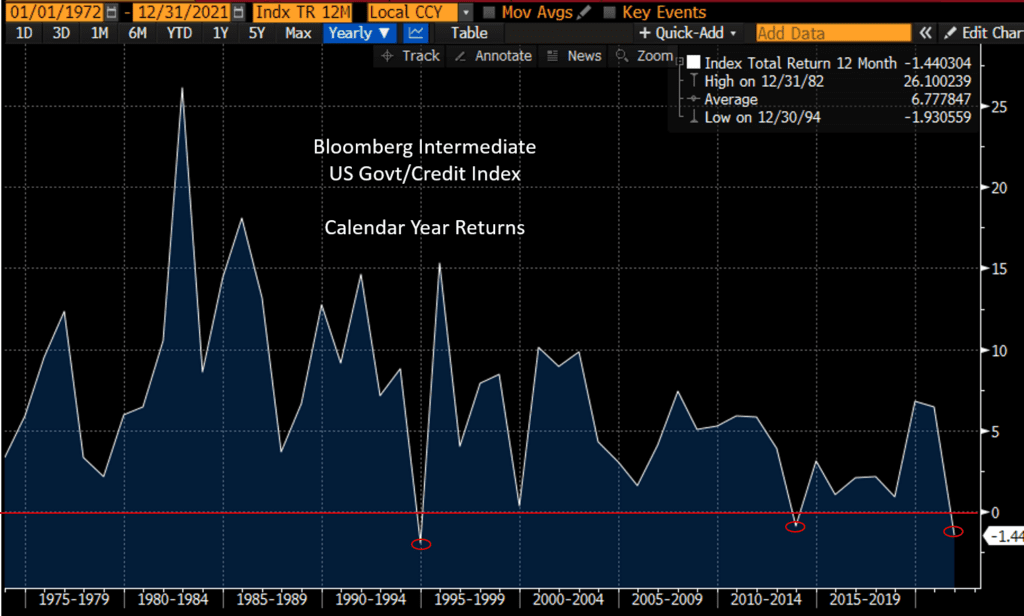

A negative return can come as a surprise to bond investors. Bonds typically exhibit less price volatility than other investments, provide ballast within a portfolio when riskier assets decline in price and can go many years without producing a negative calendar year return. In almost 50 years of history, the Bloomberg Intermediate Government/Credit bond index has only recognized a handful of negative annual returns.

Source: Bloomberg; Nottingham Advisors 2022

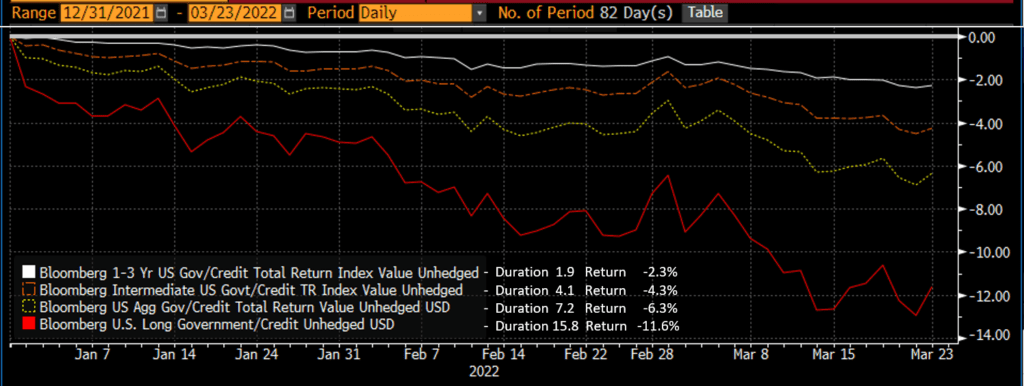

Even with a long history or providing relatively stable returns, bonds are not invulnerable. In a challenging rising interest rate environment, drawdowns are difficult to sidestep. With domestic inflation approaching double digits, and the Federal Reserve positioning itself to aggressively raise interest rates while reducing its Quantitative Easing (QE) program of buying significant amounts of Treasury bonds, fixed income investors face a difficult backdrop. Year to date, bonds have experienced one of their worst spates of performance in recent history, with the longest Duration portfolios being impacted the most.

Source: Bloomberg; Nottingham Advisors 2022

There are some strategies that can be incorporated into portfolios to help reduce the negative impact of rising interest rates.

- Reducing the Duration of bond portfolios during periods of rising rates provides some insulation, lessening the severity of a drawdown.

- Floating-rate fixed income securities with minimal duration provide protection against the negative price impact created by rising interest rates.

- Higher yielding bonds that produce more cash flow can also provide some cushion by allowing a portfolio to earn its way back from price declines at a faster rate than a lower yielding portfolio would be able to.

- Positions that have been negatively impacted can be utilized for tax-loss swaps, offsetting gains/income and perhaps creating a carryforward to offset future taxes.

We are actively implementing these strategies when it makes sense, as we continue to navigate uncertainty and volatility in the fixed income markets. If you have questions about your fixed-income holdings or any elements of this letter we would be happy to discuss. We thank you for your trust in us and for your continued support!

Timothy Calkins, CFA

Co-Chief Investment Officer

Timothy serves as a member of the Nottingham Investment Policy Committee. He brings over 22 years of investment experience to the team. Timothy is responsible for corporate and municipal credit research & trading, as well as contributing to our economic outlook and interest rate expectations. He also leads our alternative investment research and custom allocations, with a focus on private credit and liquid alternatives. Timothy’s membership and active participation with the Buffalo Angels group keep him connected to the local start-up community.

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client.

For more information about Nottingham’s offerings, visit www.nottinghamadvisors.com or call 716-633-3800.

Nottingham Advisors, LLC (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent, direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in your account will correspond directly to any benchmark index. A description of each index is available from us upon request.

Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.