Here are some things to consider as you weigh potential tax moves before the end of the year.

Set Aside Time to Plan

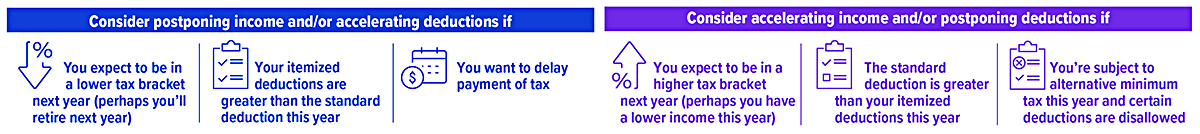

Effective planning requires that you have a good understanding of your current tax situation, as well as a reasonable estimate of how your circumstances might change next year. There’s a real opportunity for tax savings if you’ll be paying taxes at a lower rate in one year than in the other. However, the window for most tax-saving moves closes on December 31, so don’t procrastinate.

Defer Income to Next Year

Consider opportunities to defer income to 2023, particularly if you think you may be in a lower tax bracket then. For example, you may be able to defer a year-end bonus or delay the collection of business debts, rents, and payments for services in order to postpone payment of tax on the income until next year.

Accelerate Deductions

Look for opportunities to accelerate deductions into the current tax year. If you itemize deductions, making payments for deductible expenses such as medical expenses, qualifying interest, and state taxes before the end of the year (instead of paying them in early 2023) could make a difference on your 2022 return.

Make Deductible Charitable Contributions

If you itemize deductions on your federal income tax return, you can generally deduct charitable contributions, but the deduction is limited to 50% (currently increased to 60% for cash contributions to public charities), 30%, or 20% of your adjusted gross income (AGI), depending on the type of property you give and the type of organization to which you contribute. (Excess amounts can be carried over for up to five years.)

Increase Withholding

If it looks as though you’re going to owe federal income tax for the year, consider increasing your withholding on Form W-4 for the remainder of the year to cover the shortfall. The biggest advantage in doing so is that withholding is considered as having been paid evenly throughout the year instead of when the dollars are actually taken from your paycheck.

More to Consider

Here are some other things to consider as part of your year-end tax review.

Save More for Retirement

Deductible contributions to a traditional IRA and pre-tax contributions to an employer-sponsored retirement plan such as a 401(k) can help reduce your 2022 taxable income. If you haven’t already contributed up to the maximum amount allowed, consider doing so. For 2022, you can contribute up to $20,500 to a 401(k) plan ($27,000 if you’re age 50 or older) and up to $6,000 to traditional and Roth IRAs combined ($7,000 if you’re age 50 or older). The window to make 2022 contributions to an employer plan generally closes at the end of the year, while you have until April 18, 2023, to make 2022 IRA contributions. (Roth contributions are not deductible, but qualified Roth distributions are not taxable.)

Take Any Required Distributions

If you are age 72 or older, you generally must take required minimum distributions (RMDs) from your traditional IRAs and employer-sponsored retirement plans (an exception may apply if you’re still working for the employer sponsoring the plan). Take any distributions by the date required — the end of the year for most individuals. The penalty for failing to do so is substantial: 50% of any amount that you failed to distribute as required. Annual distributions from inherited retirement accounts are generally required by beneficiaries (as well as under the 10-year rule); there are special rules for spouses.

Weigh Year-End Investment Moves

Though you shouldn’t let tax considerations drive your investment decisions, it’s worth considering the tax implications of any year-end investment moves. For example, if you have realized net capital gains from selling securities at a profit, you might avoid being taxed on some or all of those gains by selling losing positions. Any losses above the amount of your gains can be used to offset up to $3,000 of ordinary income ($1,500 if your filing status is married filing separately) or carried forward to reduce your taxes in future years.

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client.

For more information about Nottingham’s offerings, visit www.nottinghamadvisors.com or call 716-633-3800.

This content has been reviewed by FINRA.

Prepared by Broadridge Advisor Solutions on behalf of Nottingham Advisors. © 2022 Broadridge Financial Services, Inc.

This article has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

Nottingham Advisors, Inc. (“Nottingham”) is an SEC-registered investment adviser with its principal place of business in the State of New York. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of Nottingham, as well as its fees and services, please refer to our disclosure statement as asset forth on Form ADV, available upon request or via the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). The information contained herein should not be construed as personalized investment advice or a solicitation to buy or sell any security. Investing in the stock market involves the risk of loss, including loss of principal invested, and may not be suitable for all investors.

Past performance is no guarantee of future results. This material contains certain forward-looking statements which indicate future possibilities. Actual results may differ materially from the expectations portrayed in such forward-looking statements. As such, there is no guarantee that any views and opinions expressed in this material will come to pass. Additionally, this material contains information derived from third-party sources. Although we believe these sources to be reliable, we make no representations as to the accuracy of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change without prior notice. Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.