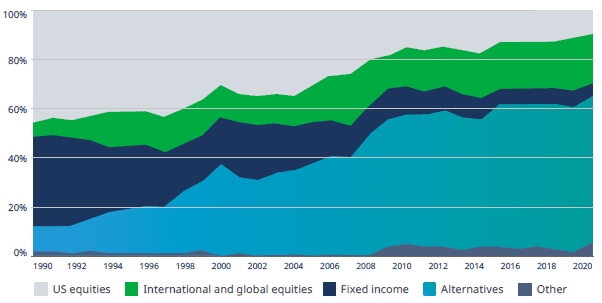

Interest in private market alternative investments has continued to increase. This was initially driven by the largest institutional asset owners pursuing the “endowment model” or “Yale model,” popularized by legendary investor David Swenson, Chief Investment Officer of Yale’s endowment for over 30 years.

Endowment asset allocation: Largest institutions

Source: 2020 NACUBO-TIAA Study of Endowments. The “largest” category for 1990-1997 was > US $400 million and for 1998-2019 > US $1 billion.

He took the helm of Yale’s endowment in 1985 and remained CIO until he died in 2021. During that time, he grew the endowment asset base from $1 Billion to over $30 Billion.

The success of the model, and Swensen’s willingness to share his insights in his bestselling book, Pioneering Portfolio Management, raised awareness of the opportunities available in alternative investments.

More recently, public market investment valuations have incentivized investors to consider adding alternative investments to diversify their portfolios, to access less efficient markets, and add yield to portfolios that may have traditionally focused on Government and Investment Grade corporate bonds currently offering historically low yields.

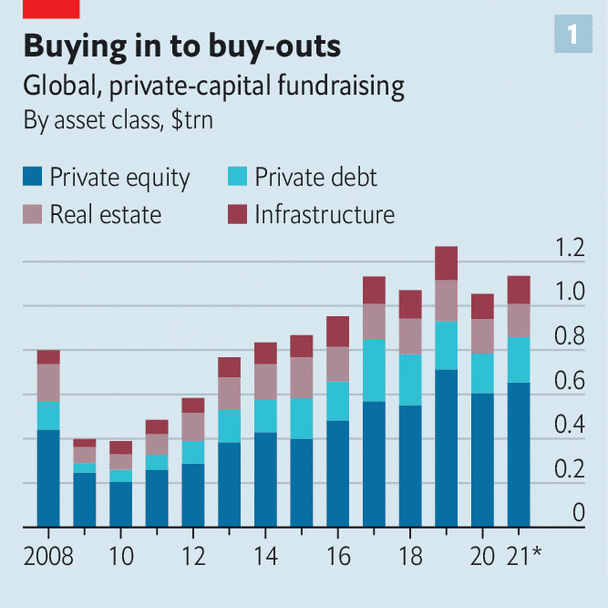

*December 6th, 2021

Source: PEI Media, December 2021

The Economist magazine recently argued that continuing to refer to private investments as “alternative” investments, or Alts, was absurd given the considerable growth in assets allocated to them. Private capital firms manage a record $10 Trillion, which equates to roughly 10% of total assets globally. Many of the largest investors allocate 10% to 50% or more of their portfolios to the private markets.

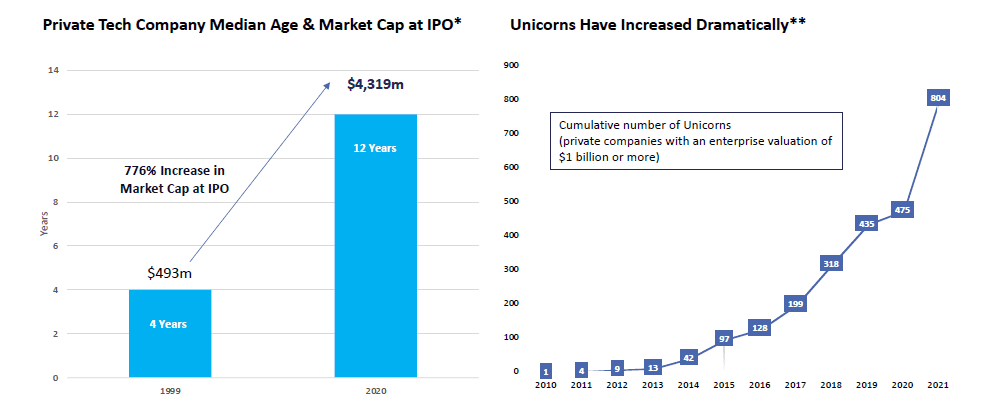

As the number of publicly traded companies declines and private companies remain private longer and achieve much higher valuations before entering the public equity markets, the case for owning private companies has grown.

Companies Are Staying Private Longer

*Reflects larger private market, not Fund holdings. Source: Initial Public Offerings: Updated Statistics, Jay R. Ritter, Cordell Professor of Finance, University of Florida, August 25, 2021.

**Source: CB Insights, as of 8/31/2021.

Private companies have been able to access enough capital through private market investors that “going public” by holding an Initial Public Offering (IPO) is often not necessary to fuel continued growth. Instead, private market investors fund that growth and earn a significant return on their investment as the company’s valuation continues to grow. The eventual IPO is no longer an opportunity for outside investors to participate in the company’s growth, but instead is a liquidity event for the private investors to sell their holdings and recognize the private market gains. This has perhaps made private market exposure even more valuable now, than when Swensen began his push in the mid-1980s.

As private investment managers have looked to expand their pool of potential clients, they have adopted new investment vehicles that increase liquidity. This helps to overcome one of the main drawbacks of private market allocations, the potential for invested capital to be locked up for close to a decade.

Another often cited concern is the historically high level of fees within alternative investments. As private market investment managers have begun competing for new clients and fee visibility has grown, costs have begun to decline on the more accessible funds in the space.

While the Yale Model is not suitable for all investors, the private markets are becoming more accessible within traditional investment accounts. For those who want to harvest the potential illiquidity premium offered by these investments and have a knowledgeable advisor to guide them, this is a great step forward.

Timothy Calkins, CFA

Co-Chief Investment Officer

Timothy serves as a member of the Nottingham Investment Policy Committee. He brings over 22 years of investment experience to the team. Timothy is responsible for corporate and municipal credit research & trading, as well as contributing to our economic outlook and interest rate expectations. He also leads our alternative investment research and custom allocations, with a focus on private credit and liquid alternatives. Timothy’s membership and active participation with the Buffalo Angels group keep him connected to the local start-up community.

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client.

For more information about Nottingham’s offerings, visit www.nottinghamadvisors.com or call 716-633-3800.

This article has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

Nottingham Advisors, Inc. (“Nottingham”) is an SEC-registered investment adviser with its principal place of business in the State of New York. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of Nottingham, as well as its fees and services, please refer to our disclosure statement as asset forth on Form ADV, available upon request or via the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). The information contained herein should not be construed as personalized investment advice or a solicitation to buy or sell any security. Investing in the stock market involves the risk of loss, including loss of principal invested, and may not be suitable for all investors.

Past performance is no guarantee of future results. This material contains certain forward-looking statements which indicate future possibilities. Actual results may differ materially from the expectations portrayed in such forward-looking statements. As such, there is no guarantee that any views and opinions expressed in this material will come to pass. Additionally, this material contains information derived from third-party sources. Although we believe these sources to be reliable, we make no representations as to the accuracy of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change without prior notice. Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.