Private Clients

Nottingham creates a unique investment experience for individuals, built around integrity, service, and performance.

Financial Advisors

OUTSOURCED CHIEF INVESTMENT OFFICER (OCIO)

We have a long history of partnering with financial advisors to help them win business and keep business.

institutional investors

We offer institutions extensive experience, sophistication, and professionalism when helping them achieve their goals.

The Nottingham difference begins with our sharp focus on building the

best portfolio to meet your personal goals.

Customization at every level

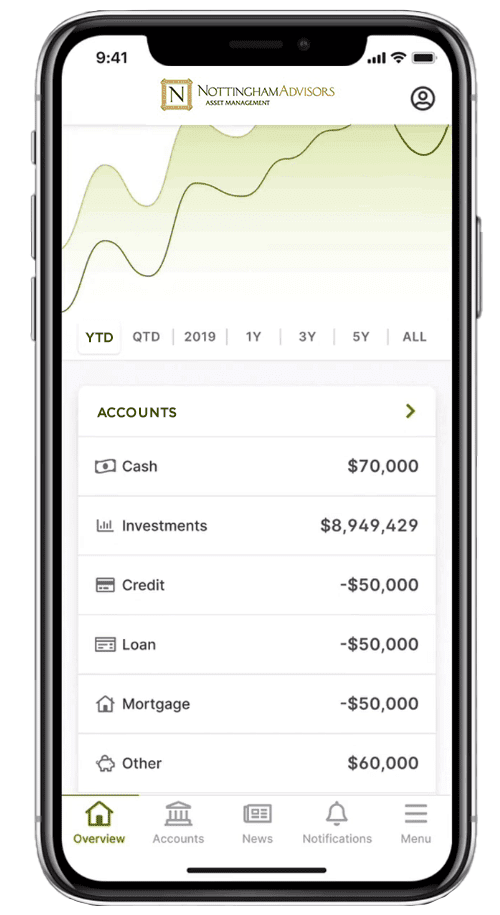

Nottingham Advisors employs dynamic asset allocation models for our clients, in separately managed accounts. These allow us to tailor each portfolio to the specific needs of the client, considering their unique risk and return profile.

The holistic approach

Nottingham leverages its extensive experience, sophistication and professionalism to help clients achieve their financial goals. Dynamic risk-based portfolios, often centered around liquid, low-cost ETFs, help clients navigate through uncertainty. Nottingham’s team strives to bring clients a consistent, transparent and repeatable investment process, helping ensure financial peace of mind.

Market Insights

Nottingham strives for transparency, communicating with clients every step of the way. From our Monthly Market Wrap, to the quarterly CIO Letter, to the periodic A View From the Top, we look to share our thoughts with clients in real time, helping you stay abreast of ever-changing markets.

f.a.q.

You have questions…We have answers

Can’t find an answer, we have a dedicated staff to help guide you with all of your questions. Please reach out to [email protected].

Far removed from the noise of Wall Street, Nottingham Advisors is a mid-level asset manager that takes pride in the individualized services provided to our clients.

An exchange-traded fund is an investment vehicle that trades daily on an exchange, offers intra-day liquidity, is fully transparent, and is tax efficient. ETFs track an underlying index and hold a basket of stocks, bonds, and/or alternative asset classes such as currencies, commodities, and real estate.

Contrary to popular belief, not all ETFs are created equal. Nottingham Advisors specializes in ETF due diligence and implementation, utilizing ETFs’ benefits since 2001.

Nottingham Advisors has developed investment strategies based on the core-satellite approach to asset allocation. The core-satellite approach seeks to gain core “beta” exposure with 80% of the strategy’s holdings, utilizing the remaining 20% satellite to tactically add “alpha” to the portfolio.

Nottingham Advisors utilizes both passive and active management strategies. In terms of passive management, Nottingham has been a strong believer in the power of indexing since ETFs were first used in client accounts back in 2001. We also offer an active management approach through the Nottingham Advisors Select Managers Program (NASMP).

No. Nottingham Advisors employs separately managed accounts (SMAs) that keep each individual’s assets separate. All portfolios are structured and managed to a client-specific risk and return target.

Nottingham Advisors manages investment portfolios for both retail and institutional clients, including, but not limited to the following: Non-qualified personal accounts, IRAs, 401(k), 403(b), 529s, Trusts, Defined Benefit Pensions, Endowments, Profit Sharing Plans, Foundations, Religious Institutions, and Not-for-Profits.

Nottingham Advisors charges a management fee based on a percentage of the client’s account value. The fee is paid in advance on a quarterly basis. See our ADV for more details on our fees.

Nottingham Advisors has a stated minimum account size of $100,000.

As a registered investment advisor, Nottingham Advisors does not function as a custodian, but instead manages client assets on a variety of platforms.

Nottingham Advisors partners with investment advisors to help them win business and keep business.

Yes. Nottingham Advisors claims compliance with GIPS ®. Information on our GIPS ® verified composites can be furnished upon request.

Nottingham communicates with clients regularly through our publications, newsletters, and videos. We publish both weekly and monthly commentary.

As an SEC registered investment adviser, Nottingham Advisors has a fiduciary duty to act in the best interest of its clients at all times. This means that we will seek to put the clients’ best interest first and act with skill, care, diligence and good judgment. In addition, we will provide full and fair disclosure of all important facts and avoid conflicts of interest.

Form ADV is the uniform form used by investment advisers to register with both the Securities and Exchange Commission (SEC) and state securities authorities. Part 2A contains information such as the types of advisory services offered, the adviser’s fee schedule and conflicts of interest. Part 2B provides the educational and business background of management and key advisory personnel of the adviser.

Nottingham utilizes both the step-out and block trading functions to trade in size and achieve best execution for all clients.

Latest Financial News

Our advisors at Nottingham are constantly engaged with what’s happening around the domestic and international markets. Read the latest posts from our top watched news outlets.

Contact Us

Visit us or give us a call today to learn more about our offerings.

100 Corporate Pkwy

Suite 338

Buffalo, New York 14226

Phone: +1 (716) 633-3800

Email: [email protected]