“The only thing we know about the future is that it is going to be different.” – Peter Drucker

2023 is officially in the books and what a strange and ultimately wonderful year it was for investors. A wholly unanticipated “Santa Claus rally”, ignited by a dovish pivot from the Federal Reserve, took equity indices to near all-time highs. Bond prices rallied as well, with the 10-year Treasury yield ending the year at 3.88%, up slightly on the year, but well below the mid-October high print of 5.00%.

Aside from this amazing end of year rally, perhaps what stood out the most for us last year was the dominance that a handful of companies had on market returns. The “Magnificent 7” as they were coined (Apple, Amazon, Meta, Microsoft, Nvidia, Tesla, Alphabet) accounted for nearly 2/3 of the S&P’s 24% return. The reason? Aside from their exposure to the burgeoning Artificial Intelligence (AI) wave and the US consumer, while S&P 500 earnings were flat in 2023, the Mag 7 saw a 33% rise in EPS, as the other 493 companies collectively were down 5%.

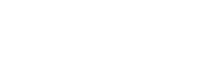

The influence of a handful of stocks aside, what really turned the tide for most investors was dovish speak from Fed officials beginning in late October suggesting interest rate hikes were over This followed on the heels of some decidedly disinflationary economic data. As a rising tide lifts all boats, the end of year rally was broadly inclusive, from cap-size to sector to country. The chart below illustrates this tale of 2 periods.

Source: Bloomberg; Nottingham Advisors. Price Returns. SPY – SPDR S&P 500 ETF; IJR – iShares Core S&P Small Cap ETF; IJH – iShares Core S&P Mid-Cap ETF; IEFA – iShares Care MSCI EAFE ETF; IEMG – iShares Core MSCI Emerging Markets ETF; AGG – iShares Core U.S. Aggregate Bond ETF

2023 provided investors a welcomed relief rally following the agony of 2022. Despite Q4’s heroic surge, however, the S&P 500 is just flat from the end of 2021 on a price return basis. Most of the other sectors illustrated in the chart above remain in the red for this 2-year period, with the U.S. Aggregate Bond Index still off -13%! And yet, animal spirits seem alive and well as we enter 2024, led by the mercurial community of crypto investors, driving every nonsensible (IMHO), speculative token towards fresh highs. When even the admittedly phony Dogecoin rallies 40% in the 4th quarter, what’s a sane investor to do?

As we begin a new year, bond yields remain near decade-long highs (despite a meaningful decline from peaks set in October), while equities present investors with a bit of a Hobsons choice. Current levels might suggest rational, valuation-sensitive investors find alternative places to put their money. With Treasury bills and money markets yielding 5%, nearly $6 trillion of investor cash has indeed found a new home, if only temporarily. Yet the potential for equities to move higher in 2024 may prove sufficient reason to stay the course and focus on the long-term (a fundamental tenet of the Nottingham playbook).

Much as no one foresaw the drop in 2022, nor the rally in 2023, no one knows what 2024 may bring. The list of concerns is high: frothy valuations; slowing growth; heightened geopolitical tensions; election year drama; the list is endless – and it always is. This year is no different in terms of the many things to wring our collective hands over – the list changes, but there’s always something. As we’re paid to have an opinion on such matters, and recognizing we’re throwing darts, (albeit with a seasoned hand), here goes nothing.

Let’s assume the Fed follows through on its none-too-subtle suggestion that inflation is back under control, and it will likely be lowering interest rates come summer. Let’s also assume that corporate earnings can grow 5-10% in 2024 (they didn’t in 2023). And that broader regional wars in the Middle East and Russia don’t erupt this year. And that Donald Trump doesn’t do anything too crazy come election time. Oh yes, and that AI begins to unlock much hyped productivity gains, and doesn’t destroy the world. Should all of the above happen (a low probability event), stocks should do well. If all of the above don’t happen (also a low probability event), look out. BUT, if enough of the above comes to fruition, markets could do okay. As we said, just like any other year. Speculate in the short-term, invest for the long-term.

We were gratified to see the strong Q4 rally in US small and mid-cap stocks, after expressing enthusiasm for them the past year or two. Same for international equities, which we were beginning to harbor doubts over. As mentioned earlier, the bulk of the gains in the S&P 500 were in a handful of tech-oriented companies. A few sectors had modest returns in 2023 – Healthcare, Energy, Financials – and look reasonably valued. There are some less obvious opportunities across both equity and debt markets. Cash Equivalents remain attractive short-term options for nervous investors.

Lastly, the continued evolution of the Alternatives marketplace has created opportunities to gain exposure to private equity, private debt, hedge funds and private real estate, more easily than ever before. While still the domain of the upper net worth investor, as minimums typically run in the $25k to $50k per investment range, these alternative areas can offer diversification in the form of returns non-correlated to the stock market, as well as portfolio risk reduction. Nottingham is actively exploring opportunities in this space for accredited and qualified investors.

If nothing else, 2023 proved the value of staying the course. Witness some benign inflation data, combined with dovish Fed-speak, and markets were off to the races. As we start this New Year, it may behoove investors to revisit their return requirements, as well as their risk tolerance. We’re all another year older. Bond yields are still very attractive and present compelling hedges to equity risk. That said, inflation is likely to remain elevated when compared to the past decade. Investors should target returns of at least 4% to 5% nominal in order to preserve purchasing power. If you don’t have a financial plan in place yet, call us and we’ll help.

On behalf of all of us at Nottingham Advisors, we thank you for your continued faith and trust in us. We remain committed to helping our clients realize their financial goals. If we can be of any assistance to you (or a friend!) as you plan the year ahead, please don’t hesitate to reach out.

Larry Whistler, CFA

President

Larry joined Nottingham in 2006 and heads the Investment Policy Committee, along with portfolio and relationship management responsibilities. He brings over 32 years of investment experience to the team. Before joining Nottingham in 2006, Larry worked as an independent RIA for two years and spent a decade as a bond trader for Merrill Lynch Capital Markets in Los Angeles and New York City.

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client.

For more information about Nottingham’s offerings, visit www.nottinghamadvisors.com or call 716-633-3800.

Nottingham Advisors, Inc. (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent, direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in your account will correspond directly to any benchmark index. A description of each index is available from us upon request.

Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.