Clients are often curious about the pros and cons of contributing to a Traditional IRA versus a Roth IRA. Below we highlight the important characteristics of these retirement savings vehicles.

WHAT’S THE DIFFERENCE?

A Traditional Individual Retirement Account (IRA) and a Roth IRA are both powerful tools to help individuals save for retirement. However, there are several key differences to keep in mind when deciding which account, or combination of accounts, makes the most sense for your specific financial situation.

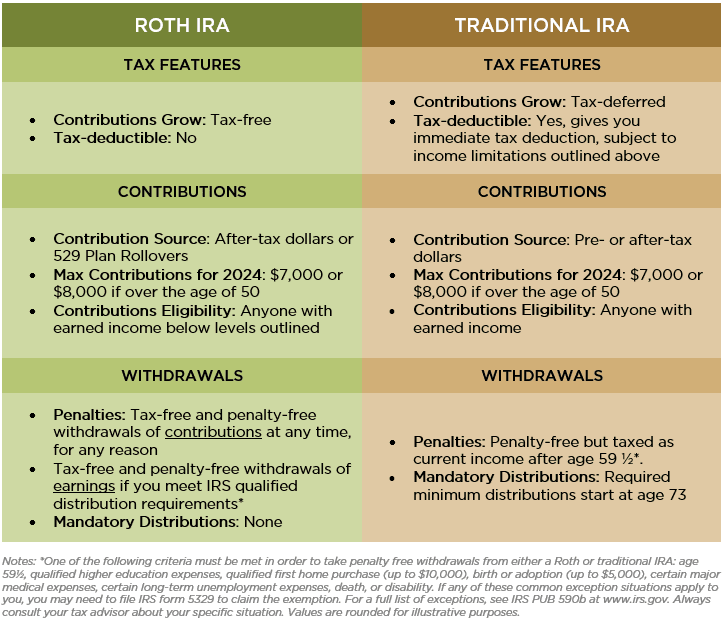

ROTH IRA

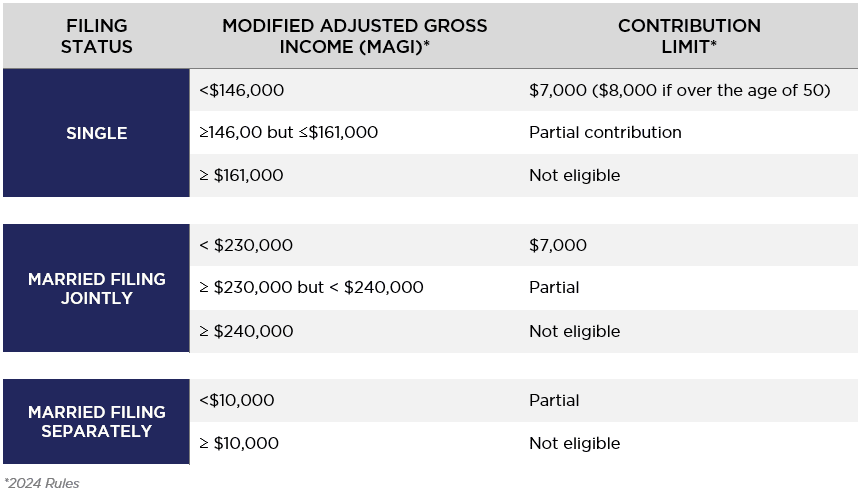

A Roth IRA allows you to make after-tax contributions. Before exploring the advantages of a Roth IRA, it is first important to recognize that there are certain income limitations that determine contribution eligibility.

A Roth IRA is likely best suited for an individual who expects to be in a higher tax bracket when he or she begins taking withdrawals, because they will be paying income tax on their current contributions, and receiving future withdrawals tax-free.

TRADITIONAL IRA

A Traditional IRA provides the opportunity to make pre-tax contributions. Contributions are tax deductible, subject to certain constraints. If the account owner or their spouse is covered by a workplace retirement plan (401(k), 403(b), SEP IRA, or SIMPLE IRA), there are income limitations that phase out the deductibility of contributions, and must be considered.

A Traditional IRA is likely best suited for an individual who expects to be in a similar or lower tax bracket when he or she starts taking withdrawals, because they will be receiving a tax deduction now, on contributions, and paying tax later, when withdrawals are made.

We stand by, ready to answer your questions, and guide you down the most beneficial financial path in your retirement savings journey. Do not hesitate to reach out for guidance when setting up an account or making contributions.

Timothy Calkins, CFA

Co-Chief Investment Officer

Timothy serves as a member of the Nottingham Investment Policy Committee. He brings over 22 years of investment experience to the team. Timothy is responsible for corporate and municipal credit research & trading, as well as contributing to our economic outlook and interest rate expectations. He also leads our alternative investment research and custom allocations, with a focus on private credit and liquid alternatives. Timothy’s membership and active participation with the Buffalo Angels group keep him connected to the local start-up community.

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client.

For more information about Nottingham’s offerings, visit www.nottinghamadvisors.com or call 716-633-3800.

Nottingham Advisors, Inc. (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent, direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in your account will correspond directly to any benchmark index. A description of each index is available from us upon request.

Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.