Tariff Turmoil – China Reciprocal Tariffs Paused

May 2025

What Happened

Over the weekend, U.S. Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer met with their Chinese counterpart, Vice Premier He Lifeng, in Switzerland, walking away with the early stages of a trade deal. Bessent said the U.S. delegation made “substantial progress,” according to Barron’s, while Greer noted the talks were “very constructive.” U.S. and Chinese representatives appear to have established a framework for additional negotiations in the hopes of a broader trade deal, as well as the opening up of Chinese end markets for U.S. companies. This represents a de-escalation and a shift in tone toward China, which CEOs, investors, and consumers alike will likely cheer. A thawing of the ice should ease some of the uncertainty that has overtaken global markets.

Early Details

The U.S. and China have agreed to pause and reduce most reciprocal tariffs imposed in April:

- U.S. will lower tariffs on most Chinese goods from 145% to 30%, which includes an additional 20% tariff related to China’s role in the opioid crisis (i.e. fentanyl production)

- China will lower tariffs on U.S. goods from 125% to 10%

Tariffs on products such as steel, autos, and others that were already in place remain. This likely makes the total tariff on certain goods well in excess of the 30% headline rate, but a sharp decline from the broad 145% headline. Additionally, in his Monday morning press conference, President Donald Trump mentioned possibly speaking with Chinese President Xi Jinping at the end of this week, which could provide additional details and further propel equity markets.

The pause on reciprocal tariffs stands to last 90 days and now puts the U.S. in direct negotiations with nearly all countries, building on the momentum from last Thursday’s announced deal with the United Kingdom. While the UK deal itself left baseline 10% tariffs in place and covered a short list of items, it nonetheless directionally signaled a breakthrough in trade negotiations that could spark momentum for additional deals with other countries. What else is clear from this weekend, and from President Trump’s social media posts, is that he’s given authority to Bessent to decide what is acceptable, likely a welcome reprieve from more hawkish advisors that appeared to previously influence the President.

Market Reaction

Equity markets rallied sharply on the China trade news, with the S&P 500 Index gaining more than +3% on Monday, erasing most of the year’s losses. Bond yields rose as the Dollar strengthened, while Gold and other safe haven assets fell.

With Monday’s equity market gains, the S&P 500 is now essentially flat for the year. After a -19% drawdown from February highs to the post-Liberation Day April lows, equities have now regained most of their year-to-date losses. At the same time, Q1 earnings season has come with few surprises. Earnings estimates are slightly lower for 2025, but not drastically so. If there was a surprise to point out, it would be that fewer companies than expected have actually pulled their 2025 guidance, and are instead highlighting ranges of tariff-induced outcomes.

Interest rates were higher on the back of recent announcements, with the 10-year Treasury yielding 4.45%, just below where they started the year. Volatility, as measured by the VIX Index, is back to 20, its long-term average, after a surge to over 65 at peak uncertainty in early April.

What’s Next?

Moving forward, investors will be searching for early signs of economic weakness as we await further details on global tariffs. From an economic standpoint, recession fears have already been ratcheted up. Last month we wrote that the best way to think about recession risk was directionally higher than previously thought. Today, that risk looks lower, all else equal. Whether or not the U.S. actually falls into a recession remains to be seen and is not a foregone conclusion. The reality is that key economic data has not materially changed over the past two months. As of May 8, the Atlanta Fed GDPNow estimate of Q2 GDP was +2.3%, underscoring the fact that the economy remains resilient, as consumers continue to spend and unemployment remains low.

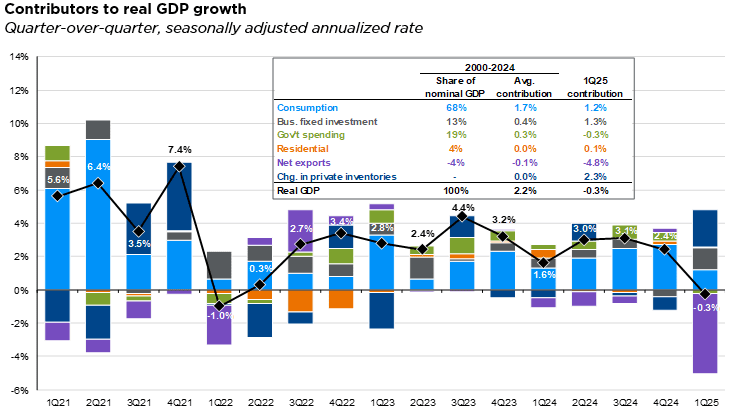

The below chart from JP Morgan shows volatility in the sub-components of GDP in Q1, which contracted -0.3% — namely that companies pulled forward imports (the purple, which detracts from GDP) and fixed investment decisions to get ahead of tariff announcements that came in April. The constant on this quarterly chart is the consumer (royal blue), which continues to spend. So long as that consumption trend continues, the “noise” within GDP sub-components should remain just that and reverse itself out over coming quarters, just as supply chain disruptions reversed coming out of the pandemic. With more than two-thirds of GDP driven by consumption, the health of the consumer remains our paramount concern.

Nottingham’s Investment Strategies

Nottingham’s portfolio strategies continue to emphasize three key tenets of our investment philosophy:

- Global Multi-Asset Diversification: Exposure to U.S. Large-, Mid-, and Small-Caps, as well as both International Developed and Emerging Markets, help to diversify equity exposure globally, while Fixed Income and Alternatives exposure help diversify volatility through lesser correlated asset classes.

- Income Generation: Emphasizing income generation across asset classes also helps to dampen portfolio volatility, as well as provide additional cash flows that add flexibility to portfolio decision making (i.e. reinvestment, distribution, tax planning, etc.). Income generation comes from equity strategies (i.e. covered call writing strategies, international equities, and high dividend equities), as well as both traditional and non-traditional Fixed Income (see below) and Alternatives (i.e. infrastructure).

- Focus on Quality: Fixed Income exposure has emphasized high quality and higher yielding investment grade securities such as Mortgage-Backed Securities (MBS), Asset-Backed Securities (ABS), and Collateralized Loan Obligations (CLOs), in addition to core staples such as Treasuries and Corporate Bonds. On the equity side, portfolio exposures to Small- and Mid-Caps emphasize quality in their inclusion screens (i.e. profitability, positive earnings, etc.), and employ actively managed strategies.

Portfolio Positioning & The Road Ahead

Nottingham’s equity strategies remain neutral on U.S. Large-Caps, with a tilt toward Small- and Mid-Caps, and away from the largest names in the market. Portfolios maintain a tactical bias toward income-generating strategies, in addition to relatively cheaper assets globally (i.e. Small- and Mid-Caps). Diversification through International Developed and Emerging Markets has benefitted from a weaker Dollar, and may continue to do so if the Dollar declines further or global recession fears abate. Alternatives such as Gold and Global Infrastructure have been safe havens.

Tax cuts and deregulation will again take center stage, with a tax bill expected as early as Memorial Day. Valuations remain elevated for the broader S&P 500, but look more attractive within Large-Cap Value, Small- and Mid-Caps, and International, all key tilts within Nottingham portfolio strategies.

The Fed looks to be on hold, as it maintains its data dependency and closely monitors its dual mandate of price stability and full employment. Inflation appears to be under control, but only time will tell the ultimate impact of global trade deals. Unemployment remains near historic lows at 4.2%, while initial jobless claims (as an early indicator of labor market weakness) have barely budged this year. After leaving interest rates unchanged in May, expectations for future Fed rate cuts continue to get pushed out to the Fall. Investors will get the next round of Fed economic projections in June’s Summary of Economic Projections (SEP).

Conclusion

While markets remain fast moving, it may be an opportune time to check in and revisit your investment strategy and financial plan with one of our portfolio managers. For portfolio specific questions, or potential tax planning opportunities, please give us a call. We’re here to help navigate market volatility together and make sure your risk tolerance and asset allocation are aligned.

Stay tuned for additional updates from our Investment Policy Committee (IPC).

Sincerely,

Matthew J. Krajna, CFA

Co-Chief Investment Officer

May 2025

Matthew Krajna, CFA

Co-Chief Investment Officer

Matthew joined Nottingham in 2012 and is a member of the Investment Policy Committee. He brings over 13 years of investment experience to the team. Matthew is responsible for conducting investment research, due diligence, and contributing to Nottingham Advisors overall investment strategy. Additionally, He is responsible for establishing the firm’s strategic and tactical asset allocations. Matthew works with investment advisors and both individual clients & institutions to help build customized investment solutions to fit their needs.

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client.

For more information about Nottingham’s offerings, visit www.nottinghamadvisors.com or call 716-633-3800.

Nottingham Advisors, Inc. (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent, direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in your account will correspond directly to any benchmark index. A description of each index is available from us upon request.

Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.