Q4 Commentary

‘Many forms of Government have been tried, and will be tried in this world of sin and woe. No one pretends that democracy is perfect or all-wise. Indeed, it has been said that democracy is the worst form of Government except for all those other forms that have been tried from time to time…’

- Winston S. Churchill, 11 November 1947

As we enter the home stretch here in 2024, I feel compelled to briefly reflect on the year that is; offer some thoughts on the year that will be (2025); and share some lessons learned while navigating client portfolios through turbulent times. In these periodic missives that investors typically find in abundance following quarter end, we usually attempt to convey a certain (timely) message to investors. Often, these are encouraging rah-rah type notes designed to bolster investor confidence. Sometimes they’re more sober. And other times they’re pragmatic, which is the goal of this note.

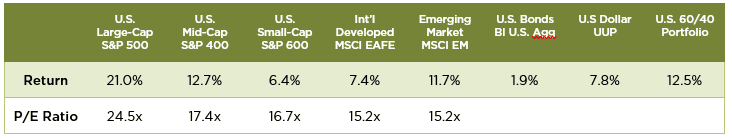

Equity markets and the S&P 500 in particular, are in rarefied territory here in Q4 – at record levels (did you know that the S&P 500 has set 47 “all-time highs” so far in 2024?), highly concentrated in 10 stocks (which are very expensive compared to the broader market), and universally over-owned. And yet, as I write, the S&P 500 is up 21% for the year, and very few analysts have “Sell” ratings on the top 10 stocks, while many are calling for equity markets to move higher.

Source: Bloomberg; YTD Returns thru 10/31/2024

We’re currently in the middle of third quarter earnings season, and are beginning to see some of the air come out of the AI bubble. The reason has less to do with the promise of AI, and more to do with the near-term prospects, or lack of, for AI-related excess profits. Recent earnings releases from the likes of Google, Apple and Microsoft would suggest that AI-related productivity gains may take some years to manifest. For some of today’s high-flying tech companies, a reckoning is long overdue. Fortunately for investors, there remain another 490 stocks in the S&P 500; along with the S&P 400 (mid-caps) and S&P 600 (small caps), and international stocks, where investors might find much better bargains.

The U.S. economy is a juggernaut relative to the rest of the world. This is in part thanks to a decade of suppressed interest rates (about 4 years too long in my opinion!), along with a massive fiscal tailwind, courtesy of our elected officials (of both parties mind you), who remain nonplussed over burgeoning federal deficits. Unemployment remains historically low; high inflation has been tamed; and GDP growth is a respectable +2.8%. So, what’s to worry about?

For one, the kindness of strangers. At year-end 2023, foreigners owned about 31% of publicly held US debt. Japan, China and the U.K. were the top 3 lenders to the US government. Two of the three can be considered friends of ours, while China uses US debt to help manage its own currency and fund a massive trade surplus with the United States. Should any of these 3 decide they don’t want to own our bonds any more, we could see a meaningful spike in interest rates. And, if the domestic bond vigilantes of 1990’s era notoriety ever re-awaken, beware. Low interest rates going forward are no guarantee, and the rising cost of debt service is crowding out more productive federal spending.

The decade of the ‘90’s saw the S&P 500 compound at an astonishing 18% per annum. The decade of the ‘00’s saw the large cap index compound at +0.41% per year. Ouch. Thus far in the 2020’s, the S&P 500 has grown at a 14.7% annual rate, largely the result of P/E multiple expansion from 21x at the start of 2020 to 25x today, along with EPS growth of about 6% per year. Going all the way back to 1928, the index has grown at about 9.7% annually (although strangely it is rare for the index to actually return 10% in any given year).

The point of all this is to suggest that going forward, investors may be rewarded for tempering their long-term capital market assumptions, at least with respect to large-cap US equities. I might even go so far as to suggest that investors may begin to get rewarded for actually diversifying their portfolios (partially!) away from the S&P 500, and certainly away from the “growth” segment of the index. As with all things under scrutiny by the SEC, treat this more as the musings of a frustrated asset allocator, and less as direct investment advice!

Rising bond yields have afforded more risk-averse investors, as well as those moving into retirement years, a great opportunity to de-risk their portfolios, while still earning a return above the rate of inflation. The common (and much maligned) “60/40” portfolio shown in the table on page one has produced a solid 12.5% return this year, while exhibiting lower volatility than a more equity-heavy portfolio. Although credit spreads remain very tight, and high yield debt is unattractive in our opinion, we think there are numerous opportunities to effectively invest capital across the corporate, mortgage-backed and municipal markets. The Fed will likely continue to cut short-term interest rates at a measured pace in 2025, assuming inflation remains tame and economic growth steady. This should provide a nice tail-wind for fixed-income returns over the coming year.

Private market investments, including private equity, private credit and private real estate, also can help investors diversify public equity market risk. Although they typically carry higher costs and can be highly illiquid and opaque, top quartile private market managers have produced solid returns over time that can be less correlated to those found in traditional public equity markets. In other words, these private market returns can “zig” when the S&P 500 “zags”, offering diversification during acute stock market drawdowns. However, manager diligence in this area is paramount as return dispersion can be very pronounced between top-quartile and bottom-quartile managers.

In case you haven’t heard, there’s a Presidential Election taking place on November 5th. The economic repercussions from the election could be profound in the short-term, but should fade as time goes on. While political theater can be fascinating for some, it tends not to have an outsized impact on equity markets over longer periods of time. Certainly, trading one’s portfolio around elections is unwise and should be avoided. Time heals all wounds in the land of equities.

We’re in a volatile period and the election certainly won’t help. Avoid falling prey to the wild speculation and observations of the talking heads on TV and social media. There is typically a lot of “doom and gloom” messaging from the losing side immediately following an election.

This time should be no different. But remember, stock markets have survived a lot over the years. There have been 16 Presidents since 1928, a Great Depression, a World War and multiple other wars (hot and cold) and conflicts, political assassinations, a credit crisis/Great Recession, a global pandemic, and through it all, the astute investor has made money by staying the course and keeping an opportunistic mind frame.

We wish it were easy to be a successful long-term investor, but it can be tough. There is a lot of noise in the investment landscape that can obfuscate even the most fundamental rules. Knowing where one wants to go, how much risk one can handle, and how long they’re willing to take to get “there” isn’t easy. Our job is to assist with these decisions. If you haven’t already, please reach out and let us know how we can help you achieve your financial goals.

Larry Whistler, CFA

President

Larry joined Nottingham in 2006 and heads the Investment Policy Committee, along with portfolio and relationship management responsibilities. He brings over 32 years of investment experience to the team. Before joining Nottingham in 2006, Larry worked as an independent RIA for two years and spent a decade as a bond trader for Merrill Lynch Capital Markets in Los Angeles and New York City.

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client.

For more information about Nottingham’s offerings, visit www.nottinghamadvisors.com or call 716-633-3800.

Nottingham Advisors, Inc. (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent, direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in your account will correspond directly to any benchmark index. A description of each index is available from us upon request.

Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.