Earlier this year, you may have heard some brief commotion about the Estate Tax proposals that were bouncing around Washington. They made headlines when proposed, then faded away, quickly drowned out by new talking points. The Biden Administration went quiet on the proposals, but will likely revisit the Estate & Gift Tax as it looks for additional sources of revenue to fund its spending targets. It is worthwhile to consider the impact of the potential changes while tax planning opportunities are still available.

The current $23,400,000 married ($11,700,000 single) Estate & Gift Tax exemption is scheduled to decline by 50% when the current rate sunsets on January 1st, 2026, unless an extension is approved by Congress. This is currently a non-starter.

Senator Bernie Sander’s proposed Bill (The 99.5% Act) looks to speed up the exemption’s decline, reducing the current $11,700,000 exemption to $3,500,000 on January 1st, 2022. This 70% reduction overnight will be sure to catch many unprepared. Sander’s Bill also increases the Estate Tax Rate from a flat 40% to a progressive 45% to 65%. The lifetime Gift Tax exemption would be limited to $1,000,000 and would no longer be indexed to inflation. The Act would also limit or eliminate some of the estate planning strategies historically favored, including Grantor Retained Annuity Trusts (GRATs), Grantor Trusts, and family entity valuation discounts.

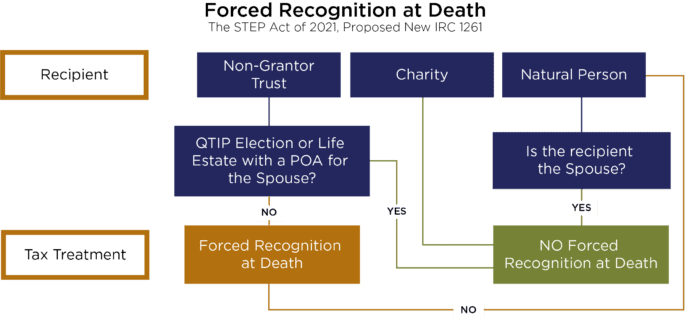

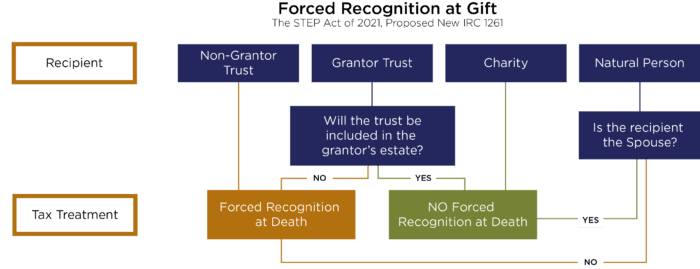

Not to be outdone, Senator Chris Van Hollen proposed the Sensible Taxation and Equity Promotion (STEP) Act. To show that he means business, this proposal would go into effect retroactively, as of January 1st, 2021. The target of this Bill is the step-up in cost basis at death, which currently eliminates the unrealized capital gains tax obligation which would otherwise be owed on appreciated assets. A current tax mitigation strategy is to avoid selling highly appreciated assets through end-of-life, which washes away the untaxed gain, passing the asset on to heirs with current market value cost basis.

The STEP act would also require gains to be recognized if assets are transferred by gifting.

Senator Van Hollen does allow for an exclusion on the first $1,000,000 of lifetime capital gains.

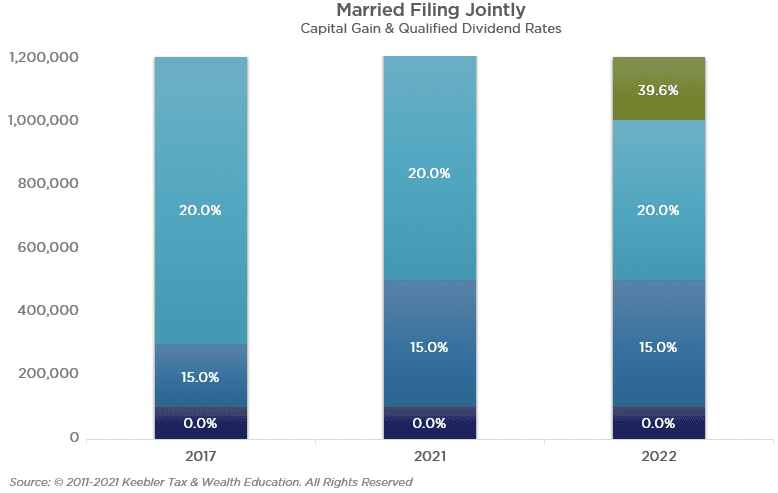

President Biden’s Fiscal Year 2022 Revenue Proposals (Green Book) included some tax increases targeting similar areas to the Sanders and Van Hollen Bills. Perhaps the most news worthy was the potential to tax long-term capital gains and qualified dividend income at ordinary income tax rates for taxpayers whose income exceeds $1,000,000.

This would likely go into effect in 2022, but there is some concern that it may be made retroactive to the date of announcement – April 28, 2021.

Any of these changes on their own would likely require a review of current estate planning, beneficiary designations, trust structures, etc. When there are this many substantial changes being proposed at one time, it becomes imperative to touch base with your trusted advisors and make sure that you are prepared for whatever may come. We are experiencing a massive reversal of the trend of the last 40 years, which was a steady and sometimes substantial progression of higher Estate Tax exemption levels and lower Estate Tax rates. Many of those now in the crosshairs of this tax were able to save, invest, or grow their business over the past decades as the Estate Tax Exemption rose along with the value of their estate. The rising exemption may have made it unnecessary to implement advanced, or even basic tax planning techniques. We appear to be on the precipice of reversing this trend, and it is time to soberly consider its potential costs.

If the proposed changes are revisited and approved suddenly, during the closing days of 2021, it will be too late to use many of the planning tools that are currently available (and may be grandfathered, if executed prior to the changes being ratified). The dramatic drop from $23,400,000 for a married couple ($11,700,000 single) down to $7,000,000 ($3,500,000 single), especially when paired with an elimination of the step-up in cost basis, will significantly expand the number of taxpayers affected by the Estate Tax. The clock is ticking. Those with an estate likely to exceed the proposed thresholds would do well to make preparations before the storm.

Timothy Calkins, CFA

Co-Chief Investment Officer

Timothy serves as a member of the Nottingham Investment Policy Committee. He brings over 22 years of investment experience to the team. Timothy is responsible for corporate and municipal credit research & trading, as well as contributing to our economic outlook and interest rate expectations. He also leads our alternative investment research and custom allocations, with a focus on private credit and liquid alternatives. Timothy’s membership and active participation with the Buffalo Angels group keep him connected to the local start-up community.

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client.

For more information about Nottingham’s offerings, visit www.nottinghamadvisors.com or call 716-633-3800.

Resources:

- Potential Tax Law Overhauls in 2021: Summary and Planning Recommendations

- PRESIDENT BIDEN’S TAX PROPOSALS – A FIRST LOOK AT THE PENDING STORM

- Sanders and Other Tax Proposals: What They Mean and What to Advise Clients to do Now

- The Van Hollen Gains at Death, Gift or Distribution from a Trust Bill (STEP): Your World May be Rocked!

- Senate Estate And Gift Tax Bill

This article has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

Nottingham Advisors, Inc. (“Nottingham”) is an SEC-registered investment adviser with its principal place of business in the State of New York. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of Nottingham, as well as its fees and services, please refer to our disclosure statement as asset forth on Form ADV, available upon request or via the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). The information contained herein should not be construed as personalized investment advice or a solicitation to buy or sell any security. Investing in the stock market involves the risk of loss, including loss of principal invested, and may not be suitable for all investors.

Past performance is no guarantee of future results. This material contains certain forward-looking statements which indicate future possibilities. Actual results may differ materially from the expectations portrayed in such forward-looking statements. As such, there is no guarantee that any views and opinions expressed in this material will come to pass. Additionally, this material contains information derived from third-party sources. Although we believe these sources to be reliable, we make no representations as to the accuracy of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change without prior notice. Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.