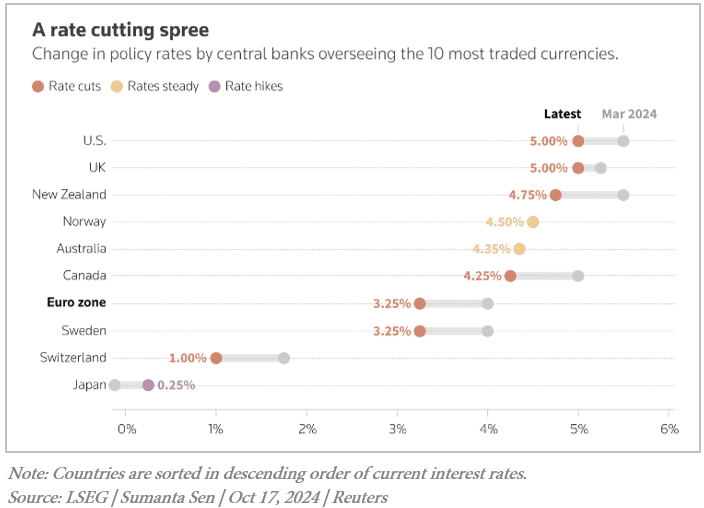

As the third quarter of 2024 approached its close, the Federal Reserve meeting that concluded on September 18th finally gave the markets what they had been anticipating for so long. Chairperson Jerome Powell announced a 50 basis-point reduction in the Federal Funds Target Rate. This oversized initial cut likely being the first in a significant series of interest rate reductions that signal the Fed’s confidence that it has subdued inflation, and potentially leading to additional economic stimulus through the loosening of monetary policy.

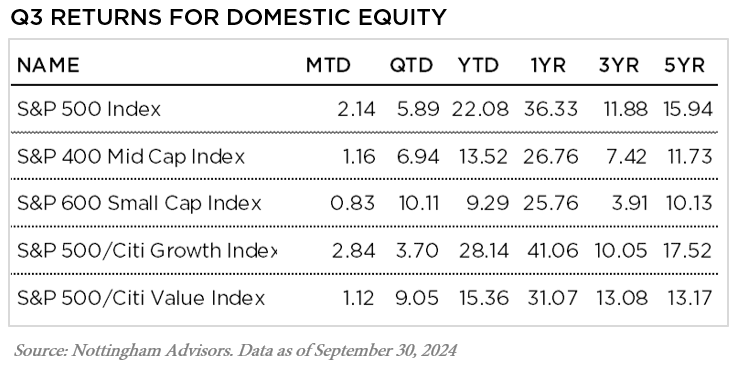

Domestic equity returns for the third quarter were broadly positive, adding to strong returns realized in prior periods, and pushing year-to-date returns into the double digits or very close to it. The S&P 500 (Large Cap) exposure has produced greater returns throughout 2024 for investors, but in the third quarter, it was outshone by even stronger returns from the smaller companies in the S&P 400 (Mid Cap) and S&P 600 (Small Cap) indices.

After lackluster returns for the second quarter, Small and Mid-Caps seemed revitalized in Q3. Smaller company returns have lagged for some time now, so some of the catchup in performance could be attributed to a reversion to mean. There was also talk of a political trade influencing the bump in returns. A Trump presidency is seen as a positive for smaller companies, with his talking points on tariffs and deregulation being beneficial to domestic companies. Market prices have begun to reflect that possibility, benefitting the exposures in our portfolios.

Growth had been leading the way for much of 2024, but in the third quarter it took a backseat to a Value trade surge, likely correlated to the Fed’s action in Q3 to loosen monetary policy. A growing expectation of falling interest rates may spur investors to migrate towards stocks that offer significant dividend yields, or holdings that typically see their prices increase as interest rates decline.

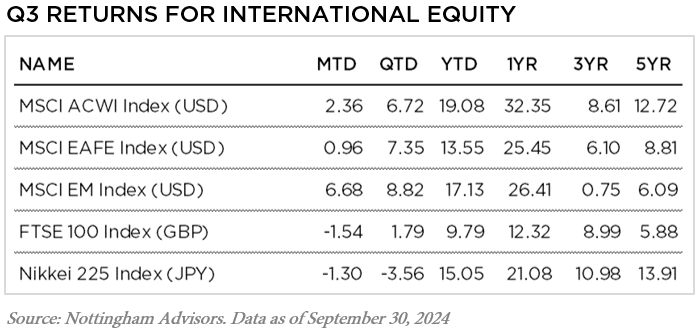

International stocks trail the S&P 500 on a year-to-date basis, while still putting up attractive returns for 2024. While the Japanese market started the year off extremely strong, it has given back roughly a third of its first quarter gains over the balance of 2024. The remaining international indices tracked have experienced a fairly steady upward progression during the year. The MSCI Emerging Markets index led the way in Q3, with a positive return approaching 9%. Some of this upside could be related to the monetary loosening being experienced in the respective countries, as interest rates have begun coming down.

International Central Banks are ahead of the U.S. Federal Reserve when it comes to loosening monetary policy. Many of these Central Banks, including the European Central Bank (ECB), Bank of Canada, Swiss National Bank (SNB), etc. have been busy lowering rates for some time now. The notable exception is the Bank of Japan (BOJ), which has only recently exited nearly a decade of negative target rates. The current Bank of Japan overnight call rate target is only 25 basis points…

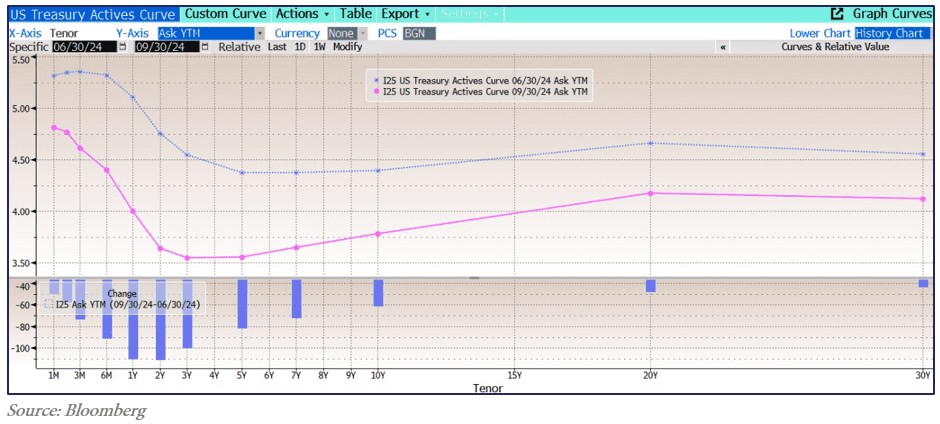

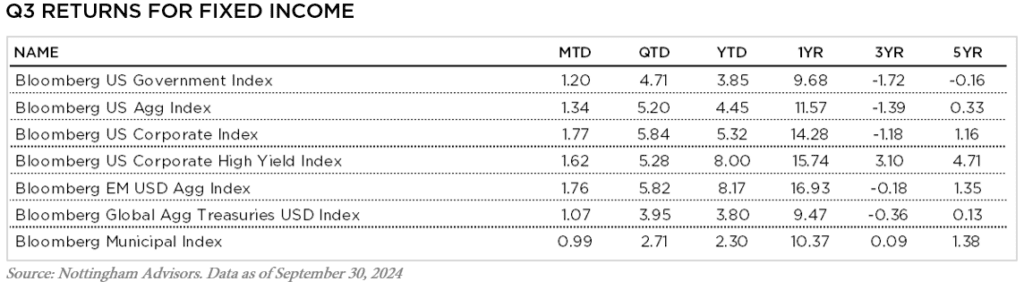

The global progression towards lower interest rates fueled Fixed Income returns during the third quarter. As interest rates decline, bond prices increase, adding to total return performance. While the High Yield market has notched up strong performance throughout 2024, most of the other bond indices tracked had posted returns that were slightly negative through Q1 and Q2 of 2024. It was not until the third quarter of the year that bond returns rallied broadly, pushing year-to-date performance into the black. Investment Grade Corporate bonds have also posted very strong performance, even as they trail non-investment grade bond (High Yield) returns. A driver of performance for both investment grade and high yield performance has been the “risk on,” environment in the bond market. The spread, or yield premium, that is offered by corporate bonds in exchange for their higher risk, has been shrinking consistently. The yield spread is very close to all-time lows, making it unattractive to be overweight significant risk in the fixed income markets.

Value in fixed income can be found through other exposures. Mortgage and Asset Backed bonds, and high-quality Collateralized Loan Obligation bonds have presented attractive yields and reasonable valuations in 2024. These exposures allow a portfolio to maintain an attractive yield without being forced into owning parts of the bond market that appear overvalued, like traditional Investment Grade and High Yield corporate bonds.

The U.S. economy has held up well, remaining significantly stronger than many naysayers had predicted. Even with many recession indicators, including the bond market’s inverted yield curve, predicting an impending economic slowdown. Employment indicators remain fairly robust, as inflation has fallen to levels that are less taxing on the consumer which drives our economy forward.

That is not to say that the cost of living is cheap. We have experienced a significant amount of price inflation in the recent past, and those increases have not reversed. The rate of further increases has slowed, and that is helpful, but not curative.

Why has the U.S. economy held up so well? Why is it so much stronger than other economies around the world? It is driven by a combination of unique factors.

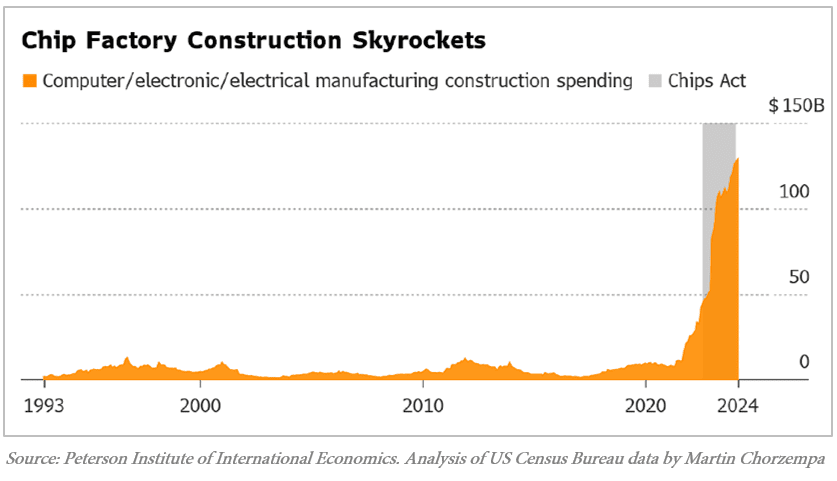

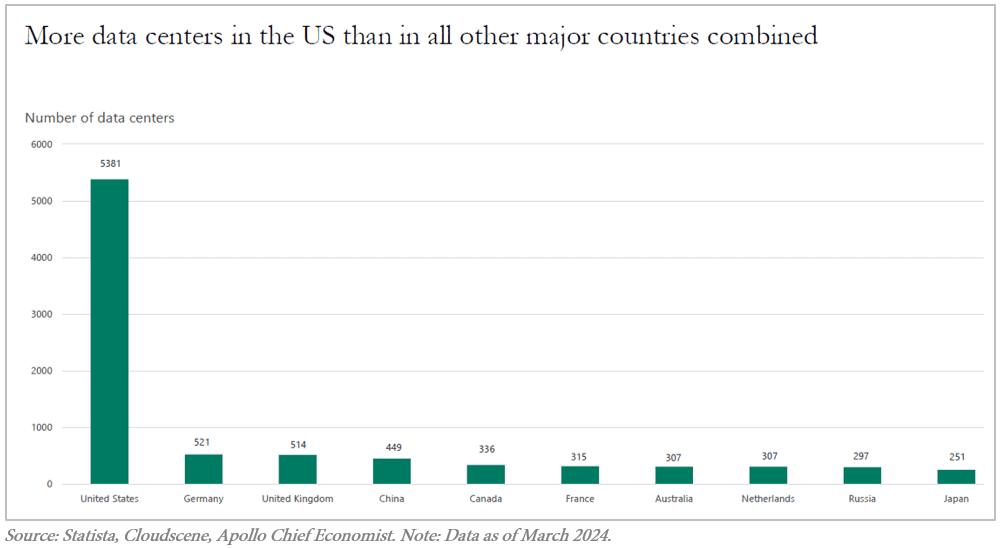

The domestic Technology/Data Center/AI boom has spurred significant corporate spending and government support. Large companies do not want to be left behind in the war for technological ability or talent. The U.S. government wants to be sure that adversaries do not gain an advantage in this arena. This is why the checkbook is wide open, public and private spending steadily flowing. Infrastructure and technological spending will continue to support economic growth.

This tailwind of investment is projected to continue to such a degree that it will drive knock-on spending/investment by utilities to grow their electrical production capacity, to power all the data centers and AI fueled energy consumption. Our positioning in Utilities and Pipelines/Infrastructure have performed strongly due to this trend. For now, it would seem that this virtuous circle of growth supporting investment has helped to protect the U.S. economy from significant damage stemming from the recent rate hike cycle.

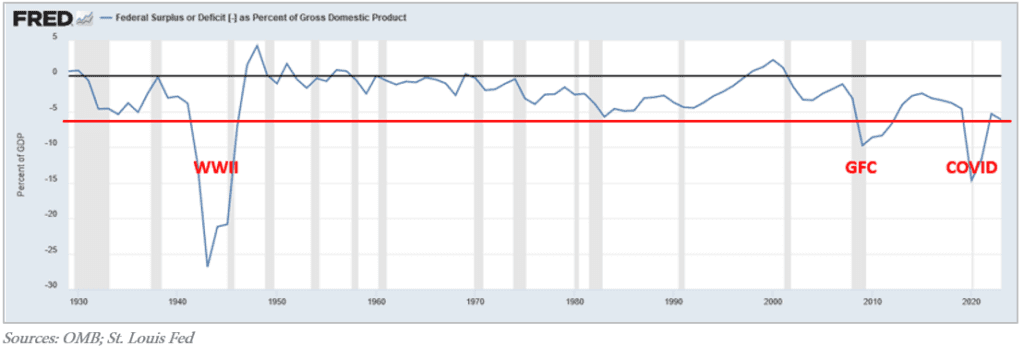

A related economic stimulant is the elevated level of overall government spending. It is not an aberration for the U.S. government to spend more money than it takes in. That happens most years. During “good times,” when employment is strong and economic growth sufficiently positive, the government may run a small deficit of 2% or 3% of GDP. When difficult economic times rear their head, Big Brother increases government spending to try to spur an economic recovery and assist those citizens most negatively affected. This leads to a larger budget deficit and concerns over fiscal sustainability. An asset that does well during this type of situation is Gold, which we have a longstanding allocation to.

The U.S. Government is currently running a large budget deficit of roughly 6% of GDP. This is unheard of during “good times.” It is particularly bizarre to be borrowing and spending so much money during a period of elevated inflation, while the Federal Reserve is attempting to lower inflation to their target range.

While it is hard to understand the justification, the deficit spending is clearly simulative to the economy, and has helped economic growth to remain vigorous domestically, while the rest of the world experiences less robust outcomes. The interest rate cuts that are expected from the Federal Reserve are likely to extend the strength that is currently being experienced.

Please reach out with any questions. We are always happy to discuss to opportunities that we are seeing.

Timothy Calkins, CFA

Co-Chief Investment Officer

Timothy serves as a member of the Nottingham Investment Policy Committee. He brings over 22 years of investment experience to the team. Timothy is responsible for corporate and municipal credit research & trading, as well as contributing to our economic outlook and interest rate expectations. He also leads our alternative investment research and custom allocations, with a focus on private credit and liquid alternatives. Timothy’s membership and active participation with the Buffalo Angels group keep him connected to the local start-up community.

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client.

For more information about Nottingham’s offerings, visit www.nottinghamadvisors.com or call 716-633-3800.

Nottingham Advisors, Inc. (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent, direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in your account will correspond directly to any benchmark index. A description of each index is available from us upon request.

Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.