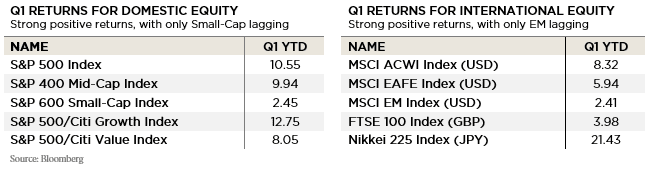

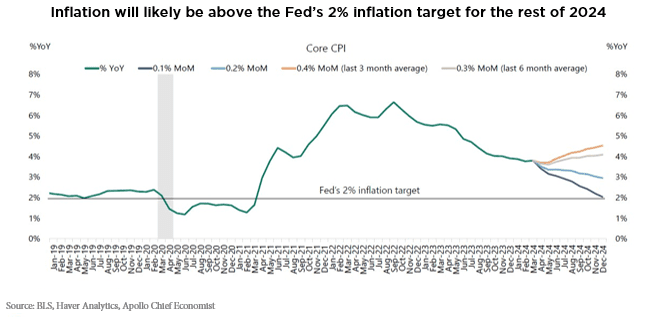

The first quarter of 2024 saw global equity performance fueled by expectations of looser monetary policy just over the horizon, as the scourge of inflation died a slow but assured death in the very near future. Chairperson Powell’s dovish pivot towards the end of 2023 was based on this premise.

The risk markets were overjoyed by the “Dot Plot” chart provided by the Fed in December, showing committee members expectations for future interest rate levels. While this data did show expectations of Fed easing (lowering rates) during 2024, the markets took the three cuts expected, and began to price in up to three or four additional rate cuts on top of those forecasted (7-8 total cuts).

Stocks moved broadly higher given the change of stance and the market’s belief that rates would come down even faster than the Fed was predicting.

This expectation was quickly challenged as strong GDP growth, good employment numbers, and hotter than predicted inflation data consistently printed during Q1.

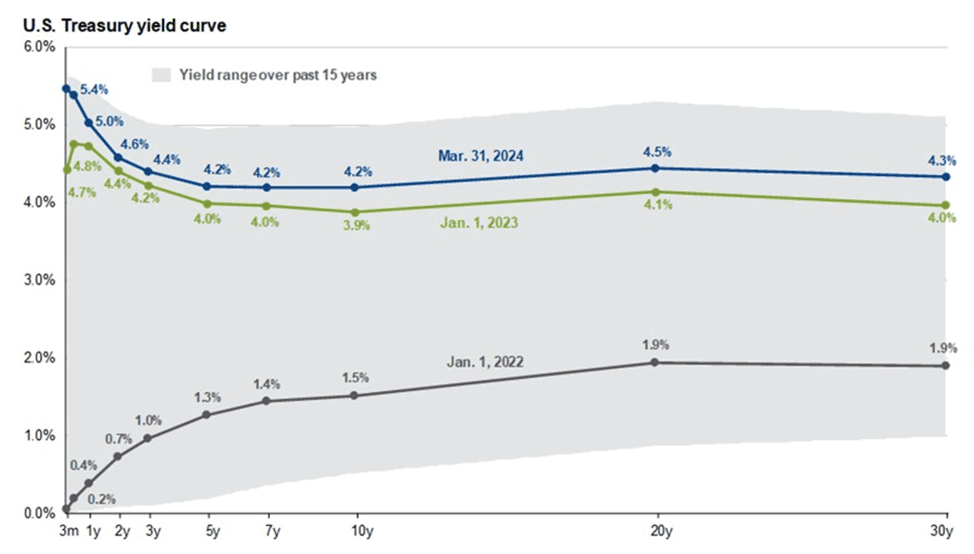

The number of rate cuts priced into the market gradually declined to equal the Feds expectation of three, and eventually fell to roughly one. In April, as interest rates rose to reflect the likelihood of a, “higher for longer,” scenario, the equity markets gave back some, though not all, of their gains.

Source: FactSet, Federal Reserve, J.P. Morgan Asset Management. Guide to the Markets – U.S. Data are as of March 31, 2024.

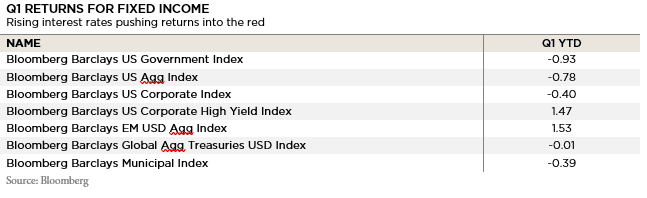

This adjustment higher in rates has pressured bond prices, leading to negative year-to-date returns in most categories during Q1. This pressure did not let up in April, further impairing 2024 bond returns. The upside to these less than stellar returns is that for the first time in over a decade, the yields offered by these fixed income investments are larger than the price drawdown that has been experienced. That means that if interest rates stabilize, and the bonds simply earn their yield going forward, the negative price impact will be erased in less than a year, and in some cases, after just a few months. This ability to quickly recover from reasonable increases in interest rates, a “self-healing” process, highlights how fixed income as an asset class has largely de-risked itself to a significant degree over the past few years as rates approached 20-year highs.

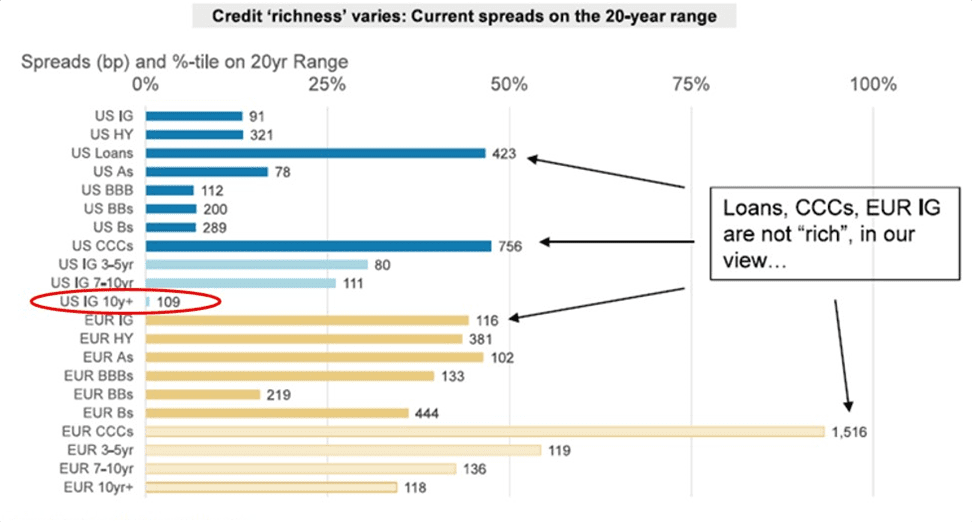

While absolute yield levels are attractive across the bond markets, there are some areas which look slightly expensive on some measures. The spread, or additional yield above Treasury bond interest rates, that is offered by corporate bonds (Investment Grade and High Yield), looks a little rich. While corporate bonds

Source: Bloomberg, Morgan Stanley Research

have performed very well recently, the value offered by owning them at today’s valuation levels has diminished. This is particularly true when looking at investment grade corporate bonds beyond 10 years to maturity. The valuation is being pushed to an extreme level by significant demand for bonds with these characteristics. The rise in interest rates has reduced the present value of pension plan liabilities, while the gains in the equity markets have increased the value of pension plan assets. This has spurred many pension plans to de-risk their portfolios, implementing Liability Driven Investing (LDI) strategies which entail selling stocks and buying long dated bonds, particularly investment grade corporates.

Other parts of the fixed income market offer more potential. Structured credit (CLOs), Asset Backed Securities (ABS), and Mortgage Backed Securities (MBS) all offer historically attractive return opportunities. These are under owned parts of the fixed income market, perhaps due to the additional complexity and historically limited venues of access for investors. This has evolved more recently, and accessing these assets has become fairly straightforward.

More broadly, with equity markets hovering near all-time highs, there is also a compelling opportunity for non-pension investment accounts to rebalance towards or transition to fixed income, while interest rates are at very attractive levels. Yields are high enough that bonds may be able to produce equity like returns in the next few years, with less volatility.

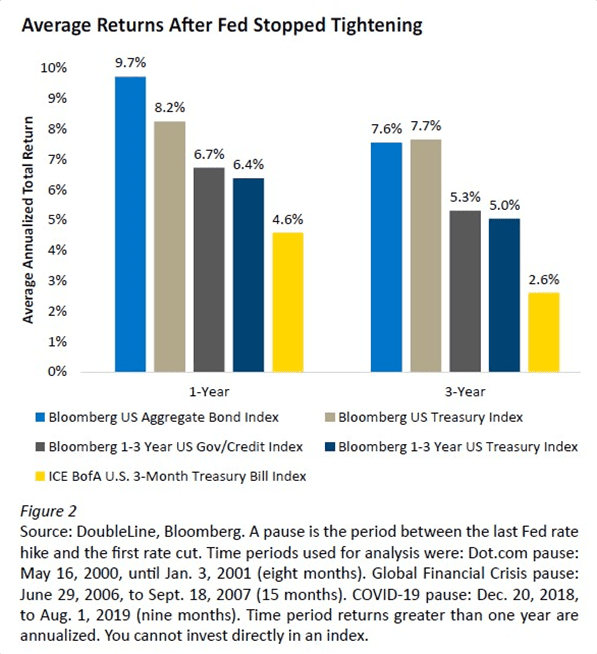

Limiting the duration of bond portfolios has been accretive to returns as rates have moved higher the past few years. Historically, when the Fed has finished hiking rates, longer Duration bonds have offered better returns than money market funds (MMF) and other short-term bond exposures. Not only does extending the average maturity of a bond portfolio allow the investor to lock in today’s attractive yields for a longer period of time, but it also offers the potential of price upside if rates decline in the future.

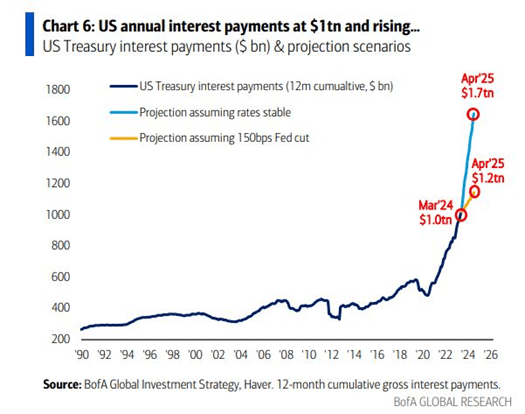

The Fed suggested that they would cut this year, and they really do not want to be wrong. The data moved against them in the first quarter of the year. More recently, GDP growth slowed, and employment data cooled. These are the types of economic releases the Fed needs to see to justify a reduction in interest rates. Chairperson Powell still needs inflation to confirm the trend by resuming last year’s trend lower before relief from rate cuts can be recognized. Consumers looking to take out a mortgage would benefit from lower borrowing rates, as would the U.S. Treasury, which is currently on pace to pay $1 Trillion in interest on the national debt, rising to almost $2 Trillion in 2025 if rate cuts do not materialize.

The current pause in monetary policy that we are in the midst of is already one of the longest on record, only exceeded by the pause preceding the Great Financial Crisis (GFC).

The size of the current deficit spending (stimulus) is a likely explanation for the length of the pause. Restrictive monetary policy has been offset to some degree (if not to a significant degree) by this stimulus, fueling the continued strong economic growth.

Whoever wins the White House in November’s election will be facing a large budget deficit and rising financing costs. Chairperson Powell will need to steel himself to avoid being influenced by the coming political pressures for monetary policy relief.

We encourage you to reach out with any questions on the markets or our current positioning.

Download the full paper below.

Timothy Calkins, CFA

Co-Chief Investment Officer

Timothy serves as a member of the Nottingham Investment Policy Committee. He brings over 22 years of investment experience to the team. Timothy is responsible for corporate and municipal credit research & trading, as well as contributing to our economic outlook and interest rate expectations. He also leads our alternative investment research and custom allocations, with a focus on private credit and liquid alternatives. Timothy’s membership and active participation with the Buffalo Angels group keep him connected to the local start-up community.

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client.

For more information about Nottingham’s offerings, visit www.nottinghamadvisors.com or call 716-633-3800.

Nottingham Advisors, Inc. (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent, direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in your account will correspond directly to any benchmark index. A description of each index is available from us upon request.

Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.